colorado electric vehicle tax incentive

2500 tax incentive on ALL new EVs in Colorado in addition to the Federal tax credit available on many models. For Colorados 5000 tax credit that means the incentive likely improved sales by 265.

All About Electric Vehicles Drive Electric Colorado

The Colorado Energy Office CEO is accepting applications for the ALT Fuels Colorado Electric Vehicle EV DC Fast Charging Plazas Program.

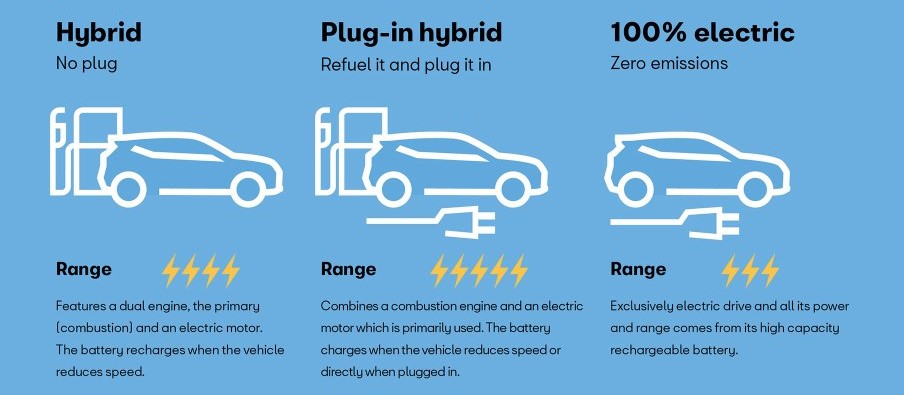

. To make the plan work the states largest power company has also tailored the new incentives to. Starting January 1 2017 new electric car buyers in Colorado will receive a 5000 flat-tax credit that can be assigned to the dealer or finance company. Hybrid electric vehicles HEVs.

The availability of electric vehicle models expanded. For example Colorado offers a 2000 tax credit for the lease of a new EV. Alternative Fuel Vehicle AFV Tax Credit.

Trucks are eligible for a higher incentive. Receive 50 or up to 250 for a new or used NEV neighborhood electric vehicle less than 3000 lbs Apply for EV purchase rebates here. Priority locations are near downtown areas high-density housing commercial developments transit hubs and transportation network company dense areas.

Plug-in hybrid electric vehicles PHEVs. Awardees must provide five years of continuous use. The 7500 credit will become available for all new cars and the 200000 cap would be eliminated - great news for Tesla and GM fans.

Xcel Energy has a new suite of programs to supercharge Colorados switch to electric vehicles. Colorado EV Incentives for Leases. Information on tax credits for all alternative fuel types.

No more standing in the wind or snow waiting at the gas pump. The Xcel Energy rebates come as the value of Colorados electric vehicle tax incentive has shrunk. Light-duty PEVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year.

Questions about the Colorado Electric Vehicle Tax Credit. Feel good about driving a car that is friendlier to the environment than your old car. There is also a federal tax credit available up.

Trucks are eligible for a higher incentive. Qualified PEVs titled and registered in Colorado are eligible for a tax credit. Receive 50 or up to 750 for the purchase of a new or used all-electric vehicle.

Titled and registered their vehicle in Colorado. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. While the federal tax credit does not apply when leasing vehicles some state incentives do.

In looking at 400 state and local incentives intended to encourage the adoption of plug-in electric vehicles since 2008 the 2018 NREL study found that for every 1000 of tax credits battery-electric vehicle sales improved 53 while similar rebates increased sales by 77. The electric car tax credit is only available to individuals with a gross income of 250000 or less decrease from before. Program objectives include improving air quality encouraging deployment of EVs across the state and supporting implementation of the Colorado Electric Vehicle Plan 2020.

Plug-In Electric Vehicle PEV Tax Credit. Tax credits are available in Colorado for the purchase lease and conversion of light medium and heavy duty alternative fueled vehicles electricEV plug-in hybrid or PHEV compressed natural or CNG liquefied natural gas or LNG liquefied petroleum gas or LPG and. Under this program the purchase of a new electric vehicle is eligibe for a tax credit worth 7500 as long as it meets the following criteria.

Information in this list is updated throughout the year and comprehensively reviewed annually after Colorados legislative session ends. There would be an additional 5000 in available incentives if the car and battery parts were built within the US. The original 5000 tax credit was one of the countys most generous when it went into effect.

Additionally the Colorado Colorado Department of Revenue only offers this incentive to qualified individuals who have. Using union labor making the total available tax credit 12500. Since its inception in 2013 the Charge Ahead Colorado program has made awards for more than 1000 EV charging stations across the state.

Vehicles with a replaced power source that use an alternative fuel. Learn about the variety of electric vehicle models and the discounts you can take advantage of from trusted dealerships around Colorado on our EV Deals page. One of Governor Polis first executive orders Executive Order B 2019 002 Supporting a Transition to Zero Emission Vehicles includes supporting the acceleration of widespread electrification of cars buses and trucks and adopting the goal of 940000 light-duty electric vehicles in Colorado by 2030.

State Incentives Plug-In Electric Vehicle PEV Tax Credit. As of 2021 Colorado offers a vehicle-related incentive for new EVs light passenger vehicles up to 2500. Does the credit apply to used electric vehicles.

You can charge at home. Purchased or converted their vehicle. Receive 50 or up to 250 for the purchase of a new or used plug-in hybrid PHEV vehicle.

If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. Top 5 Reasons to Drive an EV in Colorado. Tax credits are as follows for vehicles purchased between 2021 and 2026.

There are so many incentives available for consumers interested in purchasing or leasing an electric vehicle or installing a charger. In 2018 Colorado released its first electric vehicle EV plan setting forth goals actions. Federal and State Electric Car Tax Credits Incentives Rebates.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicle License Plate Bill Passes

Electric Vehicle Tax Credits What You Need To Know Edmunds

Tax Credits City Of Fort Collins

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Don T Miss Out On Electric Car Tax Benefit Deadlines Valuepenguin

Incentives For Purchasing Or Leasing Electric Vehicles In Colorado

Tax Credits Drive Electric Northern Colorado

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Oil Industry Cons About The Ev Tax Credit Nrdc

Rebates And Tax Credits For Electric Vehicle Charging Stations

Colorado Ev Incentives Ev Connect

How Do Electric Car Tax Credits Work Credit Karma

Biden Endorses Electric Vehicle Tax Credit Transportation Today

Zero Emission Vehicle Tax Credits Colorado Energy Office

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels